The insurance market technology renovation has been underway for decades. Momentum continues in investment, IPOs and M&A. Even COVID couldn’t stop one of our client’s drive to acquire a specialized digital engineering consultancy. We helped facilitate Capco’s acquisition of Neos to help respond to the rising demand in the Insurance world for digital strategy, operations, data and analytics assignments.

We expect the InsurTech market to continue its technology renaissance, driven in part by three forces:

In the US, the Insurance market consists of three parts: 1) Property & Casualty; 2) Life & Annuity and 3) Health Insurers. Collectively, they write more than $2 Trillion in premiums annually. This attracts more than $100bn in IT spending and another $10bn in ecosystem which includes technology, services, and consulting.

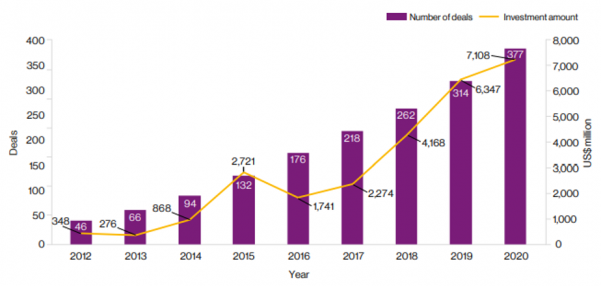

As an indication of the vitality of this market, in 2020, CB Insights noted more than $7bn was raised in 377 InsurTech funding transactions, an increase of 20% over 2019.

InsurTech Deals and Investments Over the Past 8 Years

Source: CB Insights, InsurTech 2020 Year in Review

With so much money and growth - It is no surprise the outlook for the technology that empowers the insurance market is very strong.

McKinsey highlights the 5 drivers of InsurTech activity as follows:

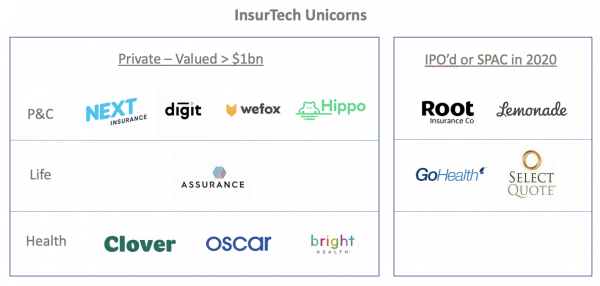

As another indicator of the momentum in Insurance technology and investment, we highlight twelve InsurTech Unicorns, a third of which IPO’d in 2020 alone.

Source: Coverager, HVA estimates

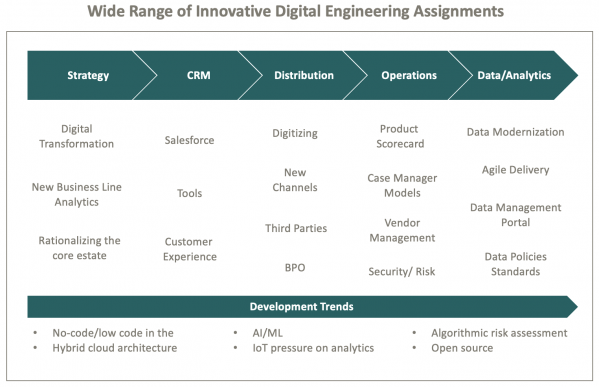

Finally, we look at the assignments our engineering and development friends are challenged with in the Insurance world and it is no wonder McKinsey notes the need for great talent to get all these projects accomplished!

Source: HVA estimates

References:

DISCLAIMER This presentation is intended for information and discussion purposes only and does not constitute legal or professional investment advice. Statements of fact and opinions expressed are those of the participants individually and, unless expressly stated to the contrary, are not the opinion or position of Harbor View Advisors, LLC (“HVA”). The information in this presentation was compiled from sources believed to be reliable for informational purposes only. HVA does not endorse or approve, and assumes no responsibility for, the content, accuracy or completeness of the information presented.